Becoming Debt-Free: 5 Easy Steps to Financial Freedom

Financial independence might mean various things to different people. Most individuals define financial security as having enough savings, assets, and cash to afford the lifestyle they choose for themselves and their families. It also involves setting up an emergency fund to allow you to retire or follow whatever career you like. It is an important goal to achieve. Nonetheless, a great deal of people never achieve financial freedom. Growing debt due to overspending or occasional financial difficulties might result in an ongoing burden that prevents you from achieving your objectives. A severe disaster, such as a storm, an earthquake, or a pandemic, might entirely ruin any planning. It may place an additional strain on your emergency finances.

What do you mean by financial freedom?

Financial freedom means owning your finances. It means having a consistent financial flow that helps you to live freely. You are not worried about your payments or unexpected costs. So, there is no better than paystubs to keep track of your earnings and achieve financial freedom. It also means having a long-term financial plan and being free of debts.

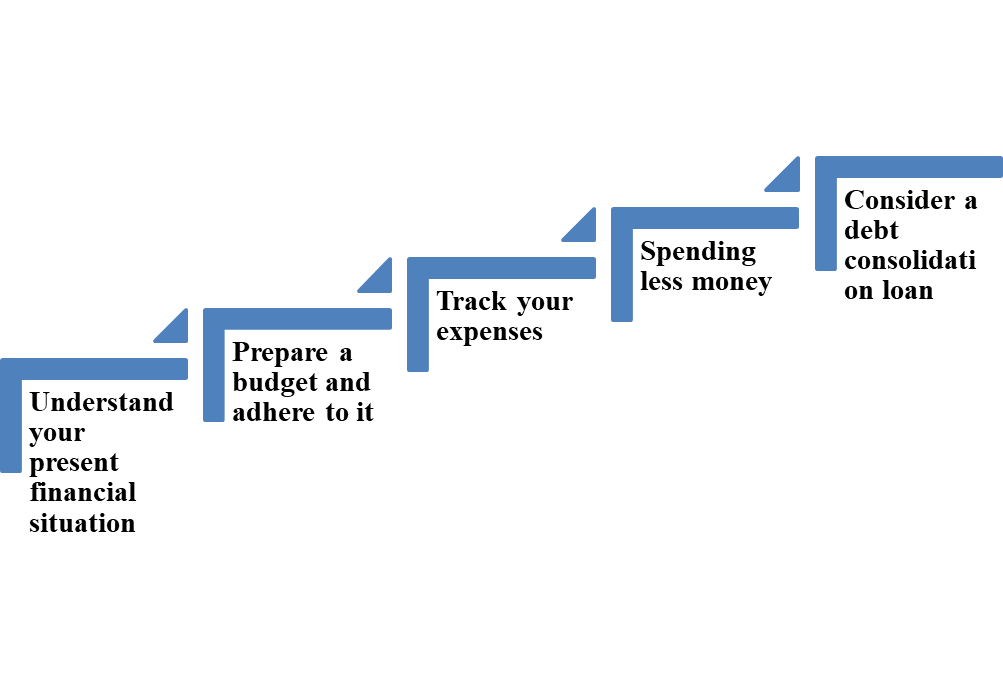

5 EASY STEPS TO FINANCIAL FREEDOM:

Understand your present financial situation

It is essential to understand your present financial condition even before you start planning to save. Above all, it is a significant step towards achieving financial freedom. You must be aware of your debts, savings, income, etc. Financial independence means knowing your starting point and keeping track of your debts and savings. You can start by listing all your debts, mortgages, vehicle loans, credit cards, and other outstanding bills. It must also include the borrowed money from your friends and family. Now, list all your funds, including savings accounts, stocks, and retirement plans. Also include recurring monthly payments, like a salary or money from a side hustle.

Prepare a budget and adhere to it:

It is vital to have a budget to follow. Your budget will help you understand the amount you have been spending and the major expenses that you have. Following a budget will not only increase your savings but also help to reduce your debts. Your budget must include your income, expenses, savings, and debts. Make your budget a realistic one so that you can adhere to it. Sticking to a budget may be difficult. You may have to make sacrifices to reduce your expenses. This is a very effective method to boost your savings and pay your debts on time. It will eventually help you achieve your goals and prevent overspending.

Track your expenses for financial freedom:

You must keep track of your expenses. It will help you understand your spending habits. You will be able to identify areas where you tend to overspend. Tracking expenses has become easy these days. There are many applications available that will help you monitor your spending. You can use apps like Mint and ETMONEY. They not only track the expenses but also provide you with details on which areas you have spent more money. It can be categories like travel, shopping, dining out, etc. You can even use notepads or an Excel spreadsheet for money tracking. Using these software and apps makes you accountable for your spending. You can then look out for unnecessary expenses and impulse buying. Once you can control them, you will be financially independent.

Spending less money for financial freedom:

You must be familiar with the phrase that money saved is money earned. Once you have set your budget and have started tracking your spending, it is time to reduce unnecessary expenses. This may involve spending less on eating out, entertainment, and other nonessential spending. Any such savings can be used to pay your debts. However, spending less does not mean you need to compromise on your existing lifestyle. Financial freedom means smart spending, which can be done creatively. You can take an example like learning to make delicious food at home, reducing your eating out expenses. Also, setting up auto-debits so you don’t pay late fees on your credit cards. Two top and crucial things work in your favor when you spend less.

- You’ll have more money to put aside for your financial freedom.

- You’ll learn that you do not need a lot of stuff to survive, which will also help you put aside more money.

Consider a Debt Consolidation Loan:

You may get a better deal on paying off your credit card debt or other debts when you combine those debts into one new loan. This is known as a debt consolidation loan. You’ll generally need fair credit to get a consolidation loan. The best debt consolidation loans, like balance transfer cards, provide a reduced APR on your debt, allowing you to save money on interest and pay off debt faster. The issue with both a balance transfer card and a personal loan is to avoid accumulating new debt while paying off the card or consolidation loan. Consolidating your debts may be useful if you have many bills. Consolidating your debt might help you save money on interest and make it easier to manage your payments. There are several options for debt consolidation, so do research to choose the best one for you.

Conclusion:

It is not easy work to become debt-free, but it is possible. You may achieve financial independence and debt liberation by following these five steps. You must retain your focus and drive throughout. You can become debt-free and enjoy the rewards of financial freedom by being dedicated and consistent. It may appear to be a sound theory. However, anyone can achieve it even if they owe tens of thousands of dollars in debt. It doesn’t matter what financial problems you currently face; there is always a solution to get back on track.